Why Banks and Insurance Companies Need To Use Service Design Process To Win and Retain Customers?

Just imagine the first thing that your insurance company asks you “ What’s your customer number?” when you are feeling emotional and vulnerable after an event like a car accident, flooding in your house, or having a wallet stolen in a foreign country. Most often these organizations forget there is a ‘Human inside the Customer’. Yet all processes and systems have been built with this as the starting point of the conversation.

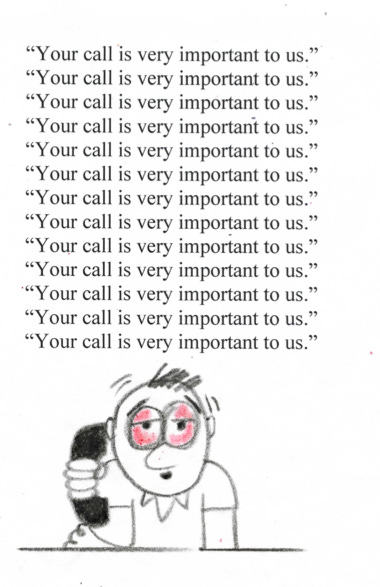

Most people dread calling their insurance company to make a claim. The expectation is that it will be a negative, complicated, time-consuming process, and at worst, they would disagree to settle the claim because of something in the small print that you forgot to read or couldn’t understand, banks are no different.

As bankers, you need to realise that being indifferent or oblivious to rising customer expectations, demands for seamless overall experience through your touchpoints, competition from emerging fintech companies, digital and technological advancements has the risks that run very high. In today’s world, banking is no longer about just money but is about the overall banking experience. Do check, are our customers with you because they love your brand or they have no choice or they are just plain habitual.

Bain & Company’s recent survey of the customers of 362 companies shows only 8% of them described their experience as “superior”. The need is urgent: customers’ have great more choices today than ever before, and more touch-points through which to pursue them. In such an environment, simple, integrated solutions to problems — not fragmented, complicated ones — will win the loyalty of the fickle-minded time-pressed customer.

Service Design is the method or the approach, that will help you solve such complex challenges. It helps you see the entire customer journey and engagement model from 35,000 ft, it reduces complexity and then helps you rethink the whole customer-organisation engagement approach. What value and experience do your organisation offer at various touchpoints and what is expected. Where are the dropouts, what is causing leakage, and what leads to dissatisfaction?

Service Design Blue Print and Tools will help you rewrite explicit and implicit value that gets exchanged between your bank or insurance company and your customers (Humans) throughout the journey. Service Design will enable you to better predict and respond to change, innovate to differentiate your brand, and create memorable experiences for your customers.

To win over these challenges and achieve success, companies would need to know more than buying habits, incomes, and other characteristics used to classify their customers’ they need to know more about the psyche, thoughts, and emotions that customers’ interactions with products, services, and brands induce. More the companies know about these subjective experiential factors and the role every touchpoint plays in shaping them, the more chances are that memorable customer experiences and deeper satisfaction will be a reality.

— — — — —

This newsletter/ post is an invitation-only community for thought leaders and top executives in successful future-oriented and human-focused brands, agencies, and organisations.